Refinancing your home loan in Australia is a financial strategy that can help you save money, reduce your monthly mortgage payments, and even reshape your overall financial future. Whether you’re a first-time homebuyer or a seasoned homeowner, understanding what is refinancing a home loan can empower you to make informed decisions about your mortgage. In this article, we’ll delve into the fundamentals of refinancing, the process involved, key factors to consider, potential risks, and how it can positively impact your financial landscape while living in Australia.

The Basics of Home Loan Refinancing

So how does refinancing a home loan work exactly? The home loan refinancing process is a financial strategy that offers Australian homeowners the opportunity to enhance their financial well-being and meet various financial objectives. At its core, it involves replacing your existing mortgage with a new one. This seemingly straightforward action, however, can bring about substantial changes in your financial situation.

Key aspects of home loan refinancing in Australia include the following:

- Securing More Favorable Terms: The primary goal of refinancing is to secure a new mortgage with terms and conditions that are more advantageous than your current loan. These improved terms can take various forms, including lower interest rates, different loan term options, or more stability in your monthly payments.

- Lower Interest Rates: One of the most common motivations for refinancing is the pursuit of a lower interest rate on your new mortgage. Even a slight reduction in interest rates can lead to substantial long-term savings.

- Changing Loan Terms: Refinancing empowers you to adjust the term of your mortgage. You can choose a shorter term to accelerate your current loan payoff or opt for a longer term to reduce your monthly financial burden.

- Transitioning from Adjustable to Fixed Rates: If you currently have an adjustable-rate mortgage (ARM) with fluctuating interest rates and desire more predictability, refinancing allows you to switch to a fixed-rate mortgage (FRM). FRMs offer consistent interest rates, safeguarding you from potential rate hikes.

- Accessing Home Equity: Through a cash-out refinance, you can tap into your home’s equity by borrowing more than your outstanding mortgage balance. The cash obtained can be used for various purposes, such as home renovations, debt consolidation, or investments. This makes the refinancing home loan process much easier.

- Loan Consolidation: Refinancing also presents the opportunity to consolidate multiple loans or debts into a single, more manageable mortgage. This streamlines your financial obligations and simplifies your financial management.

The Refinancing Process

The refinancing process, with the assistance of a refinancing mortgage broker, comes right after understanding what is refinancing a home loan. Refinancing is a significant financial decision, and before you proceed, it’s essential to understand the path ahead. This initial step not only prepares you for the journey but also ensures that you’re equipped with the knowledge and insights provided by a refinancing mortgage broker, needed to make informed decisions that can potentially reshape your .

Evaluating Your Financial Landscape

Before diving into the refinancing process, it’s crucial to assess your current financial situation. This involves examining your credit score, understanding your long-term financial goals, and determining how refinancing your home fits into your overall financial plan.

Research and Exploration

Once you’ve assessed your financial landscape, it’s time to research and explore your refinancing options. This includes comparison rates, loan terms, and lenders as well as understanding what happens when you refinance a home loan. It’s essential to shop around and get multiple quotes to find the best deal for your unique situation.

Application and Documentation

There are refinancing home loan requirements that need to be met before the process begins. After identifying a suitable refinancing option and lender, you’ll need to complete an application and provide the necessary documentation, such as income verification, tax returns, and bank statements. The lender will use this information to assess your eligibility for the new mortgage. If all the necessary information is provided and nothing is missing, the chances are high that you will get approval on the first try.

Factors to Consider to Avoid Potential Risks

When embarking on the journey of refinancing a home loan in Australia, it’s crucial to understand that each decision you make can significantly impact your financial future. To ensure you’re well-prepared, consider the following essential factors and potential risks that should guide your decision-making process:

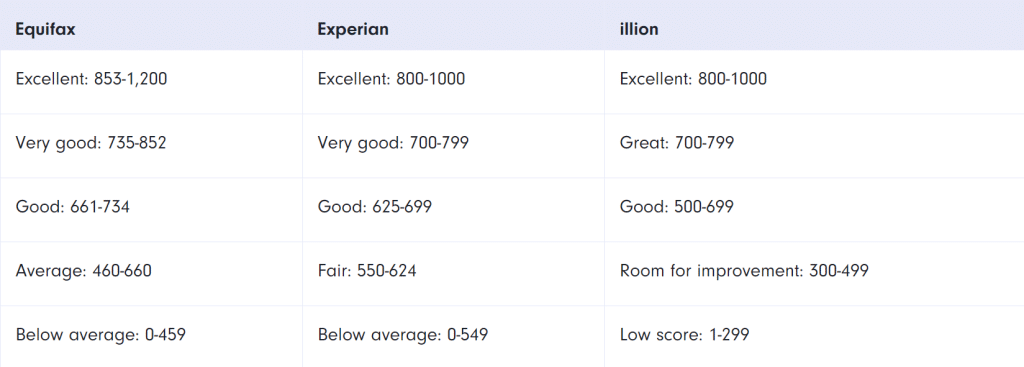

Credit scores and their role

Your credit score plays a pivotal role in determining the interest rate you’ll qualify for when refinancing your home loan while living in Australia. Lenders use your credit score as an indicator of your creditworthiness. A higher credit score typically translates to more favourable loan terms, including lower interest rates. Conversely, if your credit score is lower, you may face less advantageous terms, which could lead to higher overall costs over the life of the loan.

in Australia

Loan term options

Selecting the right loan term is a critical decision when refinancing your home loan. Your loan term is the length of time you’ll take to repay the new mortgage. It’s essential to choose a term that aligns with your financial goals and capacity.

Shorter terms

Opting for a shorter loan term, such as 15 or 20 years, can lead to higher monthly payments. However, shorter terms often come with lower interest rates, resulting in significantly reduced overall interest costs over the life of the loan. This can be an excellent choice if you can comfortably manage the higher monthly payments and aim to pay off your mortgage faster.

Longer terms

Longer loan terms, typically 30 years, offer lower monthly payments but may come with slightly higher interest rates. While this reduces your immediate financial burden, it can result in higher total interest expenses over the life of the loan. Choosing a longer term can be advantageous if you need to lower your monthly payments for budgetary reasons, but it’s essential to weigh this against the long-term cost.

Costs and fees

While there are a bunch of benefits of refinancing your home loan, it’s not without its costs. Australian closing costs, including application fees, appraisal fees, and title insurance, can add to the overall expense of refinancing. It’s essential to be aware of these costs and fees upfront, and this is where mortgage brokers in Sydney can be especially helpful. They can guide you through the process and help you calculate the break-even point. The break-even point is the point at which the potential savings from refinancing surpass the upfront expenses. By understanding when you’ll start benefiting from the lower interest rate or reduced monthly payments, with the assistance of mortgage brokers in Sydney, you can make an informed decision about whether refinancing aligns with your financial objectives.

Conclusion

Refinancing your home loan is a powerful financial tool that can help you save money, reduce your monthly mortgage payments, and achieve your long-term financial goals while living in Australia. By understanding the basics of refinancing, navigating the process with diligence, and considering the key factors and potential risks, you can reshape your financial future and secure a more stable and affordable mortgage.

Refinancing Your Home FAQs

Q: What is refinancing a home loan

A: Home loan refinancing is the process of replacing your existing mortgage with a new one to secure more favourable terms and conditions.

Q: How can refinancing benefit me?

A: Refinancing can help you lower your interest rate, reduce monthly payments, change the loan term, and tap into your home’s equity.

Q: What are the common reasons to refinance a home loan?

A: People typically refinance to lower their interest rates, reduce monthly payments, change the loan term, access equity, or consolidate debts.

Q: What do Australian banks look at when refinancing your home?

A: Banks typically assess your credit score, income, debt-to-income ratio, loan-to-value ratio, and the appraised value of your home.

Q: When should I consider refinancing my home loan?

A: You should consider refinancing when interest rates are lower than your current rate, your credit score has improved, or you have specific financial goals that refinancing can help you achieve.

Q: Can I take advantage of lower interest rates if I refinance my mortgage?

A: Yes, if current interest rates are lower than your existing rate, refinancing can offer the opportunity to secure a new loan at a more favourable rate.

Q: How long should I stay in my home before considering refinancing?

A: There’s no fixed duration. If you plan to stay in your home long enough to recoup the costs of refinancing through reduced monthly payments, it might be worth considering.

Q: What’s the difference between a rate-and-term refinance and a cash-out refinance?

A: A rate-and-term refinance is focused on securing better terms or rates, while a cash-out refinance allows you to access some of your home’s equity in cash, resulting in a larger loan amount.

Q: What role does my credit score play in refinancing my mortgage?

A: Your credit score is a significant factor. A higher score often results in better refinancing terms, while a lower score might lead to less favourable terms or limited options.

Q: Will refinancing my mortgage affect my property taxes or insurance?

A: Refinancing typically doesn’t directly impact property taxes or insurance. However, changes in the loan amount or terms might indirectly affect these expenses.

Q: Is it possible to refinance if I have an adjustable-rate mortgage?

A: Yes, it’s possible to refinance an ARM into a fixed-rate mortgage to lock in a more stable interest rate or even explore other adjustable-rate options based on your financial goals and market conditions.

Q: How does refinancing work?

A: Refinancing is the process of replacing an existing loan with a new one, often to secure better terms. It involves researching rates, applying with a lender, and, upon approval, using the new loan to pay off the original one.

Q: How long does refinancing take?

A: Refinancing typically takes between 30 to 45 days from application to closing, though this can vary based on several factors.