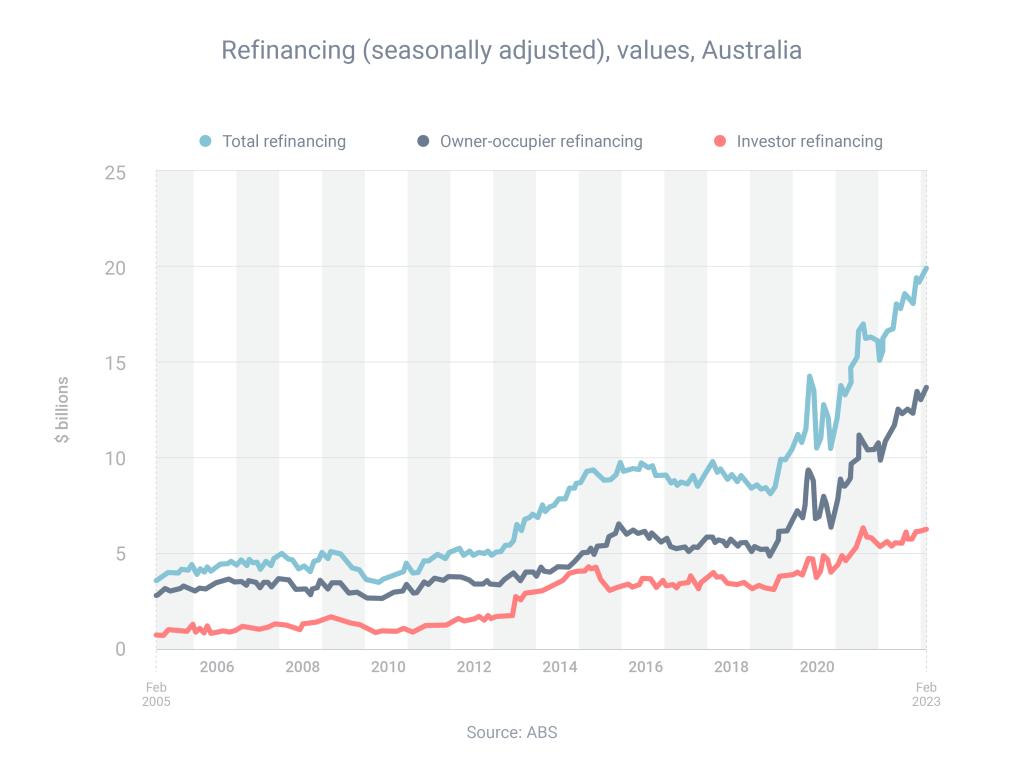

The home loan refinancing boom, which has lasted for two years and counting, has reached record levels.

Refinancing activity has dramatically increased during that time from $13.7 billion worth in February 2021 to $16.2 billion in February 2022 and, now, according to the latest Australian Bureau of Statistics data, a record $19.9 billion in February 2023.

The refinancing surge started in 2021 when interest rates were at record-low levels – at that point, many borrowers refinanced so they could lock in ultra-low fixed rates.

The surge was given fresh life in May 2022 when the Reserve Bank started raising rates – many borrowers then refinanced to lower-rate loans to ‘cancel out’ rate rises.

There’s no doubt the mortgage market has changed a lot in a short amount of time. So if it’s been at least two years since you refinanced, there’s a good chance your interest rate is unnecessarily high. My suggestion is to book an appointment so we can review your loan and see if there’s a better deal elsewhere.