Investment properties serve as a powerful tool for building wealth and securing financial independence. They offer dual benefits of regular income through rent and potential appreciation in property value over time. Investing in real estate can bring long-term financial stability. Buying an investment property requires a detailed plan, including investment goals, choosing the right location, financial preparation, conducting market research, selecting the appropriate property, and understanding legal and tax implications. This guide gives useful advice to help you make wise choices.

At Unconditional Finance, we prioritise empowering our clients with the knowledge and tools they need to achieve financial independence. Our commitment extends beyond providing expert advice; we strive to build lasting relationships that help our clients navigate the complexities of investment property ownership. We provide customised advice and clear guidance to help our clients make choices that fit their financial goals and way of life. Our finance brokers in Sydney are dedicated to making the journey of investing in real estate as seamless and rewarding as possible. Whether you’re experienced or new to investing, we give you tailored strategies and advice to help expand your property investments. With Unconditional Finance, you’re not just a client; you’re a partner in a shared journey toward financial success.

Define Investment Goals

Short-term vs. Long-term Objectives

Your investment plan should match your financial goals. Short-term goals may focus on quickly flipping properties for profit, while long-term goals typically involve holding properties to benefit from rental income and property appreciation.

Income Generation vs. Capital Appreciation

Understanding the primary purpose of your investment is crucial. Decide if you want regular rental income or big profits from property value increases. Your decision will affect the type of property you buy and its location.

Location, Location, Location

Importance of Location

1. Neighbourhood Quality

Investing in properties located in quality neighbourhoods is essential. Look for areas with good schools, low crime rates, and a strong sense of community. These factors attract reliable tenants and contribute to long-term property value appreciation.

2. Proximity to Amenities

Properties near essential amenities such as shopping centres, public transportation, parks, and recreational facilities are highly desirable. They offer convenience to tenants and enhance the property’s attractiveness, leading to higher rental demand and potentially higher rental income.

Future Development Prospects

1. Infrastructure Projects

Upcoming infrastructure projects can significantly impact property values. Research planned developments like new highways, public transport expansions, or commercial hubs. Properties located near these projects often experience value appreciation and increased demand.

2. Urban Development Plans

Urban development plans can transform neighbourhoods, making them more attractive to investors. Stay informed about local government initiatives, zoning changes, and redevelopment projects that can enhance the area’s appeal and property values.

Financial Preparation

Budgeting

1. Property Price

Establish a realistic budget for the purchase price, ensuring it aligns with your financial capabilities. Consider the market conditions and property type when setting your budget.

2. Closing Costs and Repairs

Besides the purchase price, consider extra costs like closing fees, legal fees, and possible repairs or renovations. These expenses can affect your total investment, so include them in your budget from the start.

Financing Options

1. Loan Types

Explore various mortgage options, such as fixed-rate and adjustable-rate loans. Each type has its benefits and drawbacks, depending on your financial situation and investment strategy. Consult with mortgage brokers to find the best fit for your needs.

2. Down Payment Requirements

Investment properties typically require larger down payments, ranging from 20% to 30%. A substantial down payment can lead to better loan terms and lower monthly payments, enhancing your investment’s profitability.

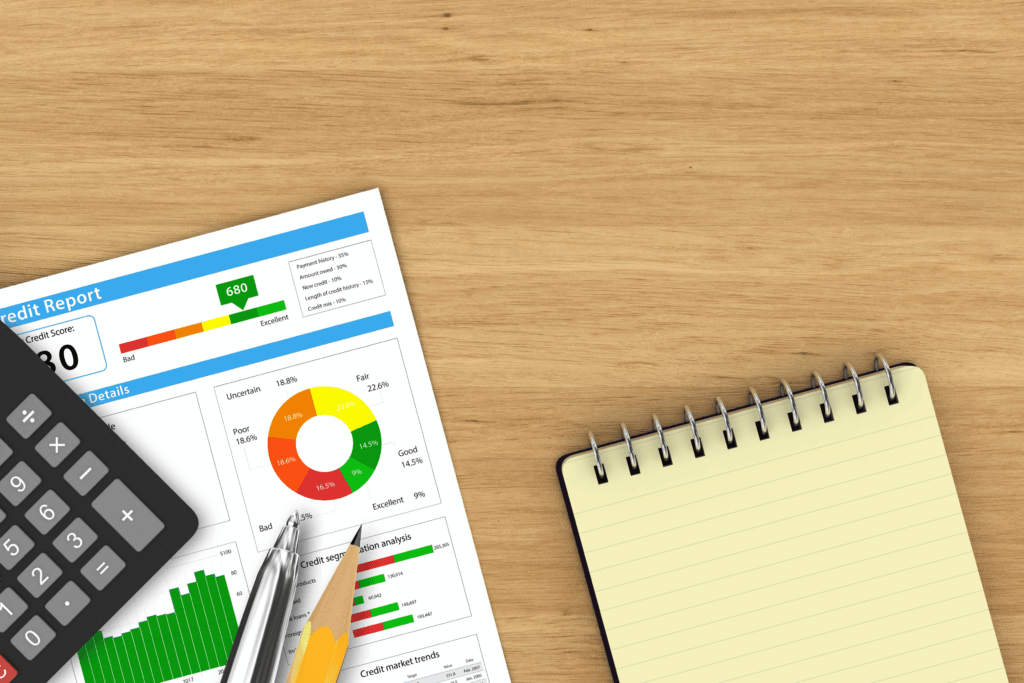

Credit Score Assessment and Improvement

Having a good credit score is important for getting favourable loan terms. Check your credit report, fix any mistakes, and work on improving your score if needed. This may involve paying off existing debts and avoiding new credit applications before buying.

Creating a Financial Cushion

1. Emergency Fund

Keep an emergency fund for unexpected costs like big repairs or tenant vacancies. This safety net helps you handle unforeseen costs without compromising your investment.

2. Operating Reserve

Set aside funds to cover ongoing operating costs, including maintenance, property management fees, and insurance. An operating reserve helps manage cash flow and maintain the property efficiently.

Market Research

Understanding the Market

1. Local Real Estate Trends

Stay updated on local real estate trends, including property values, sales volumes, and market conditions. Understanding these trends helps you make informed purchasing decisions and identify potential investment opportunities.

2. Economic Indicators

Look at economic factors like employment rates, population growth, and development, as these impact housing demand and property values. Study these to understand the market’s health and future potential.

Evaluating Rental Markets

1. Occupancy and Vacancy Rates

High occupancy rates indicate strong rental demand, while high vacancy rates may signal issues with the property’s location or condition. Research local rental markets to understand these dynamics and make informed decisions.

2. Tenant Demographics

Understand the demographics of potential tenants, including age, income levels, and lifestyle preferences. Tailoring your property to meet the target demographic’s needs can enhance its appeal and rental income potential.

Property Selection

Different Property Types

1. Single-family Homes

Single-family homes are popular among first-time investors due to their simplicity and ease of management. They tend to attract long-term tenants and offer a straightforward investment option.

2. Multi-family Homes

Multi-family homes, like duplexes and apartment buildings, can provide higher income since they have multiple rental units. However, they require more management and maintenance compared to single-family homes.

3. Condos and Townhouses

Condos and townhouses are typically easier to maintain due to shared community responsibilities. However, they may come with higher association fees and restrictions, which should be considered in your investment plan.

Analysing Comparable Properties

1. Recent Sales Data

Review recent sales data of similar properties to determine a fair purchase price and assess potential appreciation. This analysis helps in making competitive offers and understanding the market value.

2. Rental Rate Comparisons

Compare rental rates of similar properties in the area to estimate potential rental income. Understanding local rental rates helps you set competitive rents and maximise investment returns.

Property Condition and Inspection

Fixer-uppers vs. Turnkey Properties

Decide between fixer-uppers, which may be cheaper but require significant renovations, and turnkey properties, which are ready to rent but come at a premium. Consider your budget, skills, and timeline when making this decision.

Importance of Professional Inspections

1. Identifying Potential Issues

A thorough inspection can uncover structural issues, pest problems, or needed repairs. Identifying these issues before purchasing helps avoid costly surprises and negotiate better deals.

2. Estimating Renovation Costs

Accurate estimates of renovation costs are crucial for budgeting and determining the property’s profitability. Work with contractors to get detailed quotes and factor these costs into your investment plan.

Property Management

Self-management vs. Hiring a Manager

Decide if you have the time and skills to manage the property yourself or if you should hire a professional property manager. Doing it yourself can save money, but it requires a lot of time and hard work.

Costs and Benefits of Professional Management

Professional property managers handle tenant screening, rent collection, and maintenance, but they come at a cost. Evaluate if their services will improve your investment returns and alleviate management burdens.

Legal and Tax Considerations

Landlord-tenant Laws

Familiarise yourself with local landlord-tenant laws to ensure compliance and avoid legal issues. Knowing your rights and duties as a landlord is key to managing your property smoothly.

Zoning Laws and Regulations

Understand zoning laws and property regulations to avoid potential legal problems. Ensure your property use aligns with local rules and plan for any future changes in zoning that may affect your investment.

Tax Considerations

1. Available Deductions

Learn about tax deductions available for investment properties, such as mortgage interest, property taxes, and depreciation. These deductions can significantly impact your investment’s profitability.

2. Consulting a Tax Advisor

Consult a tax advisor to optimise your tax strategy and ensure you take full advantage of available benefits. An expert can guide you through tricky tax laws and help boost your investment returns.

Diversification and Risk Management

Diversifying Investments

1. Avoiding Over-concentration

Avoid putting all your investment capital into one property or location. Diversify your investments across properties and regions to spread risk and enhance stability.

2. Balancing with Other Asset Classes

Balance your real estate investments with other asset classes like stocks or bonds. This approach creates a well-rounded portfolio, reducing overall risk and improving financial resilience.

Preparing for Market Fluctuations

1. Economic Cycles

Be aware of economic cycles and market trends. Understand that property values and rental demand can fluctuate based on economic conditions. Plan for these cycles by maintaining flexibility in your investment strategy.

2. Buffer Period Strategies

Prepare for potential downturns by having strategies in place, such as securing long-term leases or adjusting rental rates. A proactive approach helps manage market fluctuations and maintain cash flow.

Insurance Coverage

Property Insurance

Ensure you have comprehensive property insurance to cover potential damage and loss. Adequate insurance protects your investment from unforeseen events like natural disasters or accidents.

Liability Protection

Consider liability insurance to protect yourself against potential lawsuits from tenants or visitors. Liability coverage safeguards your assets and provides peace of mind.

Continual Education and Networking

Stay updated on real estate trends, market conditions, and investment strategies. This knowledge helps you make smart decisions. Connect with other investors, join groups, and attend seminars to learn from experts and get valuable advice.

Conclusion

Investing in property takes careful planning, thorough research, and smart decisions. Define your goals, choose the right location, prepare financially, conduct detailed market research, select the appropriate property, and understand the legal and tax implications.

Making informed decisions and continually educating yourself are keys to successful property investment. With the right approach, investment properties can be a lucrative addition to your financial portfolio. Stay proactive, seek professional advice, and remain adaptable to market changes for long-term success.

Are you ready to move forward with your investment plans? Contact us now to speak to a mortgage broker and begin growing your property portfolio!