Expert Guidance and Customised Loan Options for Every Stage of Your Financial Journey

Embark on your homeownership journey with ease. Our brokers guide you every step of the way, from assessing borrowing capacity to securing the right loan.

Who this is for: Aspiring homeowners purchasing their first property.

Pro Tip: Start with a mortgage pre-approval to know your budget.

Buy Your First Home

Secure a better deal on your mortgage. Refinancing can reduce interest rates, consolidate debts, or shorten repayment terms.

Who this is for: Homeowners looking for optimal mortgage terms.

Pro Tip: Compare market rates with your current terms.

Get a Better Rate

Transform your home into your dream space with tailored renovation loans. We support you throughout the process, ensuring success.

Who this is for: Homeowners planning home improvements.

Pro Tip: Create a detailed plan and budget for your renovations.

Renovate with Confidence

Expand your property portfolio with structured investment loans designed for maximum returns and manageable risks.

Who this is for: Investors seeking profitable property opportunities.

Pro Tip: Have a clear investment strategy and goals.

Expand Your Portfolio

Streamlined loan solutions for individuals or entities with trust structures. Simplify complexities with our expert guidance.

Who this is for: Individuals or businesses managing assets in a trust.

Pro Tip: Keep your trust deed and financial documents ready.

Get a Trust Loan

Live where you love while investing where it makes financial sense. Our brokers help you secure competitive loans for investment properties.

Who this is for: Renters looking to enter the property investment market.

Pro Tip: Focus on high-growth areas for your investment property to maximise returns.

Start Rentvesting

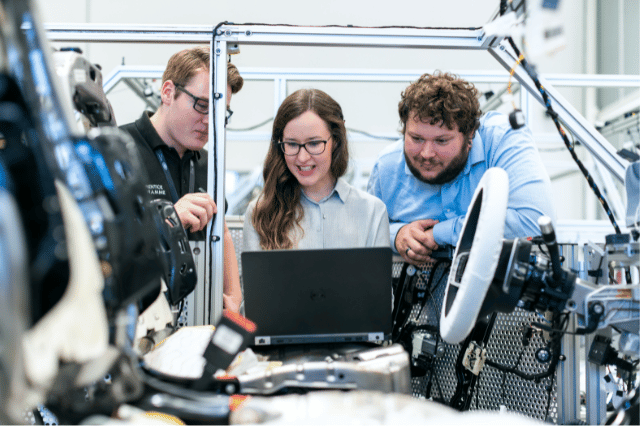

Fuel your business ambitions with tailored financing solutions. Whether you're expanding, purchasing equipment, or managing cash flow, we’ve got you covered.

Who this is for: Small business owners, entrepreneurs, and start-ups.

Pro Tip: Prepare a detailed business plan and financial projections to strengthen your loan application.

Grow Your Business

Leverage your Self-Managed Super Fund to invest in residential or commercial property. We ensure compliance and guide you through the process seamlessly.

Who this is for: Individuals managing their retirement savings through an SMSF.

Pro Tip: Work with a financial adviser to align your SMSF investment with your retirement goals.

Finance Your SMSF Property

Unlock your home’s potential with equity loans. Whether consolidating debt or funding a project, we provide expert guidance for leveraging your equity.

Who this is for: Homeowners wanting to utilise their home equity for financial goals.

Pro Tip: Assess your home’s current value and mortgage balance to determine available equity.

Unlock Your Home's Potential

Save on Lenders Mortgage Insurance with our LMI waived loans, ideal for eligible professionals. Reduce upfront costs and own your home sooner.

Who this is for: Professionals eligible for LMI waivers.

Pro Tip: Verify your eligibility for LMI waivers based on your profession and lender criteria.

Save on LMI Costs

Planning to buy a second property? Our second home loans provide flexibility and support for your goals, whether for investment or a holiday retreat.

Who this is for: Homeowners looking to purchase an additional property.

Pro Tip: Ensure your finances are in order to manage the expenses of a second home.

Secure Your Second Home

Simplify your move with bridging loans. Cover the gap between buying a new home and selling your current one with ease.

Who this is for: Homeowners transitioning between properties.

Pro Tip: Set a clear timeline for selling your current home and purchasing the new one.

Smooth Your Transition

Step into homeownership sooner with no deposit home loans. Leverage a guarantor or other options to make your dream a reality.

Who this is for: Homebuyers without a significant deposit.

Pro Tip: Consider a guarantor loan to boost approval chances for no deposit options.

Own Your Home Sooner

Switch to a home loan that aligns with your financial goals. Our brokers assist in finding better rates and flexible options.

Who this is for: Homeowners wanting to improve their mortgage terms.

Pro Tip: Review exit fees from your current lender before changing home loans.

Switch Your Home Loan

We offer tailored home loans with favourable terms for medical professionals, recognising the unique needs of your profession.

Who this is for: Medical professionals looking for specialised mortgage solutions.

Pro Tip: Provide proof of your medical qualifications and employment to access special benefits.

Get a Doctor’s Home Loan

Tailored home loan solutions designed specifically for legal professionals. Enjoy competitive rates and terms that align with your career goals.

Who this is for: Legal professionals seeking specialised mortgage options.

Pro Tip: Gather documentation of your legal practice and income stability to strengthen your loan application.

Secure a Lawyer’s Home Loan

Dependable and competitive home loan solutions designed for engineers. Let us help you build a strong financial foundation for your future.

Who this is for: Engineers looking for reliable mortgage solutions.

Pro Tip: Highlight stable employment and future earning potential for better loan terms.

Build Your Future with an Engineer’s Home Loan

As a financial expert, you deserve a home loan that aligns with your knowledge and skills. Our tailored solutions are designed for accountants.

Who this is for: Accountants seeking specialised mortgage options.

Pro Tip: Use your financial expertise to compare loan options and choose the best fit.

Finance Your Home with Confidence

Dedicated to serving those who care for others, we offer home loan solutions with favourable terms for nurses.

Who this is for: Nurses seeking home loan options with flexible terms.

Pro Tip: Leverage your stable income to negotiate better loan terms.

Find Your Nurse’s Home Loan

Tailored home loan solutions designed for self-employed individuals with unique income structures. Achieve homeownership with confidence.

Who this is for: Self-employed individuals or business owners.

Pro Tip: Keep financial statements and tax returns up to date for a smoother loan process.

Get Your Self-Employed Loan

Teachers deserve a home loan that supports their dreams. We offer personalised solutions that align with the stability of your profession.

Who this is for: Educators seeking a home loan designed for their needs.

Pro Tip: Show proof of your employment as a teacher to access special loan benefits.

Find Your Teacher’s Loan

Unlock the value of your home with equity release options. Ideal for those aged 55 and over, providing financial freedom in retirement.

Who this is for: Homeowners aged 55 and over looking to access their home equity.

Pro Tip: Evaluate your financial needs and future plans to determine the best equity release option.

Access Your Home’s Value

Secure your financial future with a retirement mortgage. Our brokers find solutions that offer stability and peace of mind.

Who this is for: Retirees needing stable mortgage solutions.

Pro Tip: Plan your retirement budget carefully to understand how a mortgage fits into your financial plans.

Secure Your Retirement

If sustainability is important to you, our green home loans offer favourable terms for eco-friendly home improvements or purchases.

Who this is for: Homeowners focused on sustainability and eco-friendly living.

Pro Tip: Research green building certifications and energy-efficient upgrades to qualify for green loan benefits.

Finance Your Green Home

Advanced financial strategies and expert guidance for sophisticated investors. Maximise returns with tailored loan solutions.

Who this is for: Experienced investors seeking advanced financial strategies.

Pro Tip: Define clear investment goals and risk tolerance to develop a robust financial strategy.

Maximise Your Investments

Make your dream holiday home a reality. Our brokers specialise in securing competitive loans for second properties, tailored to your needs.

Who this is for: Buyers looking to purchase a second property for holiday use or investment.

Pro Tip: Consider rental income potential to offset the cost of owning a holiday home.

Buy Your Holiday Home

Expand your portfolio or start a new venture with a commercial property loan. We guide you through securing the ideal loan for your needs.

Who this is for: Businesses or investors seeking to purchase commercial properties.

Pro Tip: Research the market thoroughly to choose a property with high potential returns.

Finance Commercial Property

Make an impact with NDIS-approved housing. Our specialised loans support the development of accessible properties, benefiting the community.

Who this is for: Investors and developers in the NDIS property market.

Pro Tip: Understand NDIS guidelines to ensure your property meets accessibility standards.

Invest in NDIS Property

With a guarantor home loan, family support can help you achieve homeownership sooner. Reduce deposit requirements and secure favourable terms.

Who this is for: Homebuyers with family members willing to act as guarantors.

Pro Tip: Ensure your guarantor understands their responsibilities before proceeding.

Apply for a Guarantor Loan

Principle Finance Broker

Principle Finance Broker

As many of you might know, Chris is our principle broker and founder of Unconditional Finance. Reach out to Mitchell today!

With an enormous amount of experience in the industry, as well as being an investor himself, Chris knows the importance of having loans tailed and structured in the most effective way, to allow our clients to grow their property portfolios over the long term, in line with their financial goals.

Chris has won a large number of awards and accolades over the years, including making the top 100 broker list multiple years in a row.

Outside of running the company, Chris spends his time with his wife and two young boys and loves watching sports!

Joel has been with us for the past 5 years and in that time has received an incredible amount of positive feedback from his clients.

As one of our senior mortgage brokers, Joel works with clients who are looking to build multi-property portfolios, specialising in setting up the correct structures to ensure the best possible long term outcome. He also specialises in working with those in the Australian Defence industry, where he knows all the in’s and out’s as to what benefits and schemes they are entitled to.

Outside of work, Joel enjoys golf, fishing and spending time with his friends and family.

Mitchell has been in the finance industry for over 6 years and has just recently joined the Unconditional Finance team, and boy are we lucky to have him!

As an avid property investor himself, Mitchell specialises in investment property finance, and is very good at helping our investor clients set up their loans correctly, to ensure the smooth and hassle-free growth of their portfolios.

In his spare time, Mitchell enjoys playing golf and tennis. If you’re looking to build up a sizeable property portfolio and need an expert broker on your side – reach out to Mitchell today!

Ivan is our amazing customer support manager and is quite new to the industry, he is very much enjoying learning the ins and outs of the finance world.

He is currently working alongside our senior brokers – Chris and Joel – where he provides post settlement services to our clients.

Ivan is very passionate about his job, and outside of work he is also equally passionate about keeping active with a variety of sports. He loves the beach and spending time with his friends and family on weekends.

With his level of enthusiasm you can be sure to see Ivan quickly working his way up the ranks in the world of finance.

Tylor is one of the newer members of the Unconditional Finance team, and already he is proving himself to be an absolute natural when it comes to navigating the tricky world of finance and lending.

In his spare time, Tylor likes to stay active by surfing and golfing and he enjoys going out and socialising with friends.

The main aspect of the loan process that Tylor will be helping you with, is the post unconditional stage – whereby our lender has fully approved your loan, and it’s time to purchase and settle on a property. This can be a very daunting stage, especially for first home buyers, which is why it’s always a huge relief to have a qualified expert like Tylor on your side.

Nicole brings a wealth of knowledge to the Unconditional Finance team, having been in the industry for the past 14 years. Reach out to Nicole (Finance Brocker) today!

Her area of expertise is helping our clients towards the end of the finance process, by facilitating settlements. Our clients often rave about Nicole’s amazing service, as she always goes out of her way to make sure the process is as smooth and simple as possible for the borrower.

Outside of work, Nicole enjoys going to the pub and is quite the social butterfly – a quality that is reflected in the friendly manner in which she communicates with our clients.

William has been in the finance industry since 2011, started his journey with Maquarie Bank, where he spent close to a decade gathering a wealth of knowledge in home loans department.

We were lucky enough to have Will join the Unconditional Finance team about a year ago, as he provides our team with extensive knowledge of the various processes and procedures within banks. This knowledge allows him to tailor our client’s loan applications, ensuring a smooth process from submission to unconditional approval.

Outside of work, Will spends his much-deserved time off reading crime and mystery books, playing PlayStation and binging TV shows. He is very family-orientated and loves spending quality time with his loved ones.

Stephanie has recently joined the Unconditional Finance, but has been in the banking & finance industry for 13 years, across many roles including credit analyst, mortgage broker, manager & trainer.

With her vast wealth of knowledge and experience, Stephanie has made an excellent addition to our team.

Outside of work, she loves to spend time with her husband and three boys, enjoys a good wine and cheese platter while watching the footy, and loves a good reformer Pilates session!

Jade is our newest Settlements Officer, joining our team earlier this year – however she has had over 4 years’ experience in the finance industry, having worked across various roles.

Jade is an absolute wiz when it comes to building positive relationships with our clients and ensuring they have a smooth settlement process.

Outside of work, Jade loves taking her sausage dogs on adventures and exploring new hikes and coastal walks with them.

Ryan started working with us back in September 2021, at the beginning levels of our traineeship and has recently taken on the role of Credit Analyst after proving himself to be a fast learner.

We’ve also given him the unofficial title of office IT guy after he has come to the rescue any time we’ve had a tech issue.

Outside of work Ryan likes to spend time watching and playing sport or sharing quality time with his partner, friends and family.